Services

The banking industry nowadays is extremely fast-paced and competitive, so keeping up with all the latest trends is key to staying on top of the game. One of the surest ways for banks and related businesses to do it is by adopting banking DevOps practices.

To answer this question we first need to understand what exactly is DevOps. This mysterious abbreviation basically defines a tech magic of friendship – a collaboration between software development (Dev) and IT operations (Ops) teams. As for DevOps in banking sector specifically, this collaboration is crucial for accelerating software development processes and ensuring a butter-smooth integration of new features and updates into already existing systems.

The key principles of DevOps in banking are continuous integration, delivery, and automation, so they are particularly beneficial in an industry where security, compliance, and reliability are basically its raison d'etre.

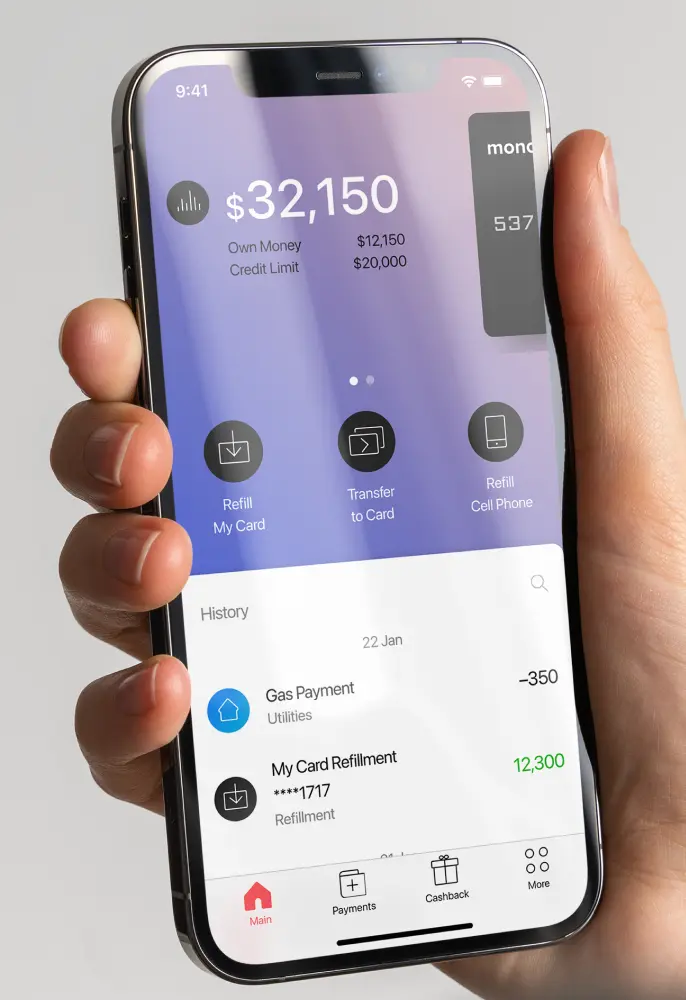

Banks that implement banking DevOps practices into their processes experience a more efficient software development lifecycle. Continuous integration allows for the frequent merging of code changes, reducing conflicts and improving code quality. Continuous delivery in its turn ensures a smooth flow of software updates into production environments, minimizes downtime and enhances the overall customer experience. Automation of repetitive tasks accelerates processes even further, enabling banks to respond swiftly to market demands and regulatory changes.

Speed and Agility

DevOps in banking sector lets banks jam out updates at lightning speed. It facilitates rapid development cycles, allowing to quickly respond to market changes and customer demands.

Enhanced Collaboration

DevOps for banking fosters collaboration between development and operations teams. No more awkward silences during dailies– just smooth communication and problem-solving.

Improved Stability and Reliability

By automating the testing and deployment processes, banking DevOps reduces risks of errors and also enhances the stability and reliability of all banking systems, ensuring a stress-free experience for customers.

Cost Efficiency

Automation and streamlined processes result in cost savings for banks, allowing them to allocate resources more effectively and invest in strategic initiatives. It's like finding a twenty in your pocket – unexpected and awesome.

Regulatory Compliance

DevOps for banking basically helps banks stay on the right side of the law with better traceability and documentation.

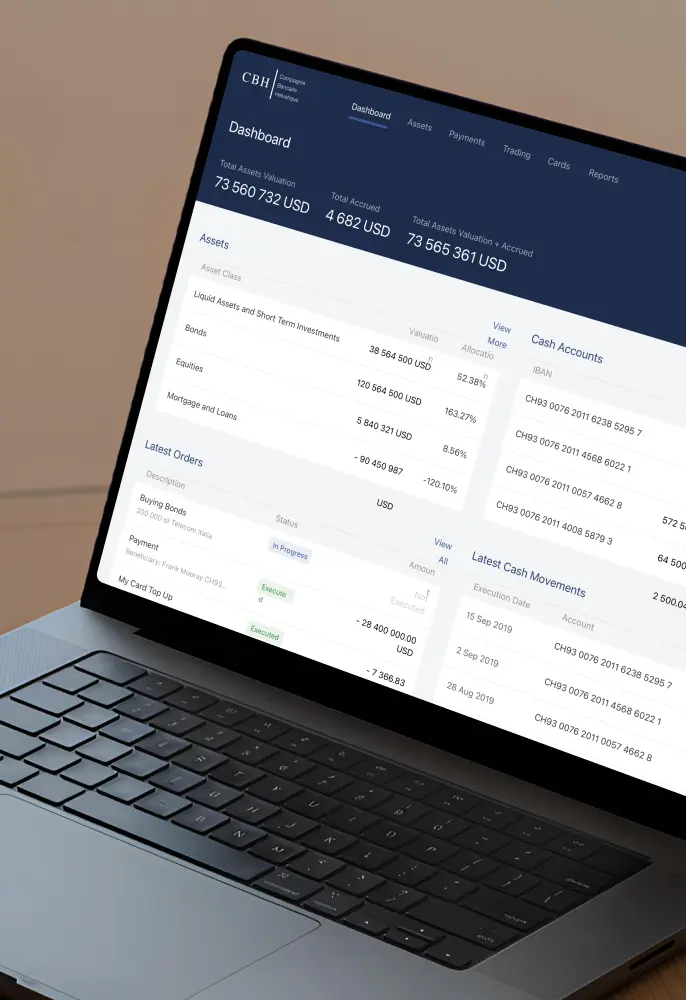

At Alty, we're not just your average tech nerds – we're your trusty guides of the digital world. Our DevOps banking services are like a customized playlist for banks, perfectly tuned to their needs. From revamping old systems to embracing the latest tech, we've got it all covered!

Our clients choose Alty for DevOps in banking because they trust in our ability to deliver incredible results. Collaboration, transparency, and a deep understanding of the banking industry run in our veins. We will make sure that our DevOps banking services align seamlessly with your strategic objectives. We get the banking world, and our track record shows we know how to make banking DevOps work its magic.