Services

Core Banking Services

If you are on this page, you might be wondering what exactly are core banking services and why in the world does my business need them?

Though it may seem overwhelming, don't fret, as we are here to guide you through the deep waters of core banking and provide you with the tailor-made solutions that will be just the right fit for both your business processes and customers.

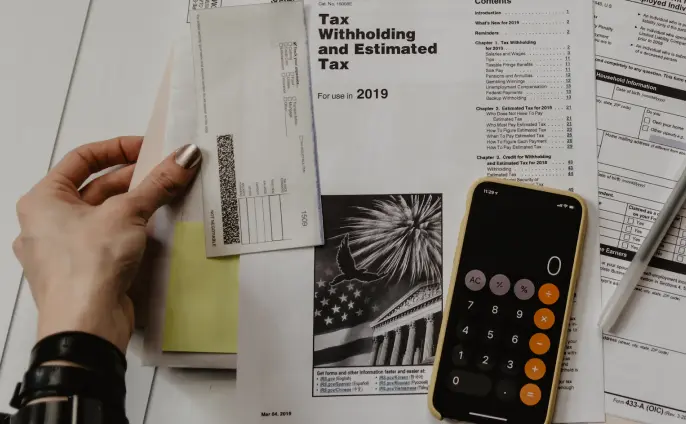

So, let's get to the core of core banking services. It has many important functions, like providing individuals and companies with basic financial services. The backbone of a banking system is basic financial services and core banking software plays a crucial role in supplying them.

Speaking in terms, core banking is a back-end system that processes banking transactions across bank branches.

The main features of the system typically are:

So far so good? See, core banking is not as complicated as it seems at first glance. What if we told you, you could go even deeper into your core banking understanding?

Let's review core banking systems modules through real-world analogies:

Whoo, that was quite a journey! Well, now that we know what exactly are core banking services and what they encompass in their processes, it's time to find out what banking solutions they can bring to your business and customers.

Core banking system is the heart of a financial institution. From money transfers to agreements, it processes all financial transactions. You can optimize all your business processes, improve your customer service, and process payments more efficiently with the help of a core banking software.

In today's banking world, core banking solutions enable the digital transformation of financial institutions. The use of modern tech helps your business to become more accessible and allows you to cover the needs of a more diverse group of customers. This way it does not matter where you created your bank account, you can use the same banking services at any bank regardless of where it was created.

If you look up the definition of core banking solutions, you will discover that it is commonly referred to as a technology solution to handle a bank's operations and services on the back end (or back office).

Core banking solutions vary in nature and are dependent on the sort of customer base that the bank serves. The fundamental aims of core banking are to increase client convenience while at the same time decreasing operational expenditures. As a result, while clients gain from greater transaction flexibility, banks win from fewer time and resources spent on repeated procedures.

Let's look at the most significant core banking solutions:

As a leader in the core banking services industry, Alty provides financial institutions with advanced solutions that simplify their work. Come see how our expertise in core banking software can revolutionize your business.

Efficiency and productivity:

Our core banking solution is able to improve the efficiency and productivity of your financial institution. For example, creating a program that automates normal banking processes like payment processing, record keeping, and reporting. This allows the employees to focus only on important tasks and increase their productivity.

Reliability and security

For financial institutions, transaction security has always been a priority. We built our core banking solution with the most modern security standards.

Support for core banking services

Our software is designed with the needs of the modern bank in mind. It can empower your business by helping you manage your accounts, transfers, loans, and deposits.

Removal of technical restrictions

We designed our core banking software with scalability in mind, so your business can grow and expand effortlessly. You will be able to easily adapt to changing market conditions and implement new technologies without technical limitations.

Increasing competitiveness

The core banking solution we offer will help your business become more competitive in the ever growing financial industry. No doubt, a company's reputation is determined by how fast and how good its service is. With our core banking software, you can both provide high-quality service to your existing customers and attract new ones at the same time.

Well, the time has come to finally open all our cards. If our profound knowledge and intricate words haven’t yet lured you to press that sweet “Contact us!” button, let us tell you in detail why exactly our services are exactly what you need for your business.

Our core banking solution has many advantages. We understand the importance of support, so we offer the best level of service after the implementation of the main banking system.

Choosing Alty's core banking services will help your business grow and thrive with efficient financial transaction processing, superior customer support and reliable core banking software.

One of the standout benefits of choosing our core banking services is the unparalleled efficiency it brings to your financial transaction processing. It's like switching from a bike to a race car - you'll experience drastically increased performance and efficiency, allowing you to get more done in less time. We designed our software to seamlessly and in real-time handle high volumes of transactions, ensuring a smooth run of all your operations, even during peak periods.

We don't need to make a 10-minute version of this article to know all too well that superior customer support is a major cornerstone of success for a business. That is exactly why we dedicate our undivided attention to you on all steps of our cooperation. We understand that a reliable banking system (just like anything in this life, really) is only as good as the support it receives, so you can count on our comprehensive assistance whenever you need it. Our dedicated support team of core banking system experts is available 24/7 to address your inquiries, promptly resolve issues, and provide empathetic and committed guidance on maximizing the benefits for your business. We are your trusted partner in navigating the treacherous seas of the financial industry.

Your financial services will be facilitated and provided with security and confidence through our specialized banking services. With our core banking solution, we will be able to help you improve the efficiency of your business as well as its competitiveness by leveraging the latest technology core banking has to offer. So, ditch the abacus and get with the times!